"An investment in knowledge pays the best interest" - Benjamin Franklin

THE DEFINITIVE RESOURCE FOR

PRIVATE LENDING AND REAL ESTATE EDUCATION

Collateral and Dangers of LTV

Hotel gurus and those that post to forums normally don’t have a formal credit background to truly understand the nuances of note buying. In this installment, we explore 7 things that can erode your lien position when you hold a note.

Mortgage-Backed Securities

Recently, I wrote an article about confusing acronyms. Real estate-related investing is no different. Two of the acronyms that keep popping up are MBS and CMBS. These common acronyms stand for “Mortgage-Backed Securities” and “Commercial Mortgage-Backed Securities” respectively. They are the vehicles by which our real estate market moves forward.

Brushing and Flossing

I remember Lucy, an admin that we had at a finance company I used to work at early in my career. Lucy brushed her teeth…a lot. Every time she would drink a beverage or grab herself a quick snack, she brushed and flossed. You see, Lucy was engaged to be married…to a dentist. Teeth were the main focus in her household. That’s just the way it was. Four out of five denists recommend brushing and flossing after you eat anything…well, I’m not sure that it’s four out of five, but that’s what I’m going with for the sake of argument.

Acronyms, Acronyms, and More Acronyms

I really hate drug company commercials. What I hate most is the explaining I must do when a prophylactics commercial pops up in the middle of Dora the Explorer. A close second to that would have to be all the acronyms I’m expected to know. COPD, ED, IBS, ABC, XYZ…I can’t keep up. I’m not a doctor, yet everyone thinks that I should automatically know what IC stands for. Every industry has their acronyms. Unfortunately, every industry also forgets that not everyone understands what they heck people are talking about when they are used.

Chickens Coming Home to Roost?

The saying goes, “The road to Hell is paved in good intentions.” Our society attempts to solve problems by throwing money at them and increasing government regulation. Well, money can’t buy happiness, or solutions for that matter. Neither is government ever the most efficient solution to our problems. The current economic upheaval left in the aftermath of the Covid-19 crisis has only been exacerbated by government intervention.

The Precomputed Interest Abyss

My first job out of college was this a consumer finance company. We would make small loans to consumers at incredibly high interest rates, but I justified it as if I was actually helping people. I was a young, naïve kid and I should have known better. The interest rates we were charging sometimes approached 39%, but more important than the rate was how the interest was calculated.

The Lesson of the Ring

It has been told that King Solomon charged one of his servants to find a ring that would make a happy person sad when they wore it and, if a sad person wore it, they would become happier. When the servant told the wise king that he could find no such ring, King Solomon commissioned a jeweler to inscribe a ring with the saying “This too shall pass.”

Realtors Stink!

I periodically peruse industry blogs to catch up on what is going on in the real estate and nonperforming loan fields. Most of the posts I see are uninteresting or they are just downright stupid. Sometimes, I see a post that is not only stupid, but it makes me think. One in particular that stuck out was a question that I see pop up from time to time, “Is it me or (do) most of these realtors (stink) at their job?” Two things come to mind when I read the question. Many, if not most realtors do not really bring value, but more importantly, are you the right customer for a good realtor?

Certainty in an Uncertain World

The real estate loan industry seems to be in turmoil at the present time. Buyers and sellers alike are struggling to make sense of a seemingly changing world. Buyers are concerned about the future of their jobs while sellers have grave concerns about the lack of buyers that are out looking for properties during the pandemic. Our real estate practice is seeing fewer buyers that are actively searching, but the ones that are searching are very serious about buying.

A Shock to the System

I remember sitting in my office in 2006 in Downtown Tampa watching all the cranes slapping up new condo buildings like there was no tomorrow. It turned out that there really was no tomorrow as soon the market was glutted with housing without enough buyers to fill them. The story was the same all over the country. Housing inventory was through the roof.

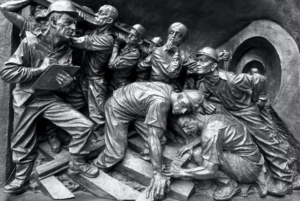

Canary in a Coal Mine

In addition to all of the consulting work we do for smaller investors and larger investors, we have our own funds, manage the funds of other entities, and we have a real estate practice that operates on the West Coast of Florida. It’s that real estate sales practice that gives us some of the most important information. It’s a canary in a coal mine, and I don’t mean the awesome song by The Police

The Patsy

There is an old saying that goes “If you’ve been sitting at the poker table for more than 15 minutes and you don’t know who the patsy is, you’re the patsy.” That’s pretty harsh, but it’s true. So many note and real estate investors try to jump into the market with both feet without having a strong background in the field only to make mistakes. The problem with making mistakes with a 6-figure property is that it can be a very expensive mistake. I’ve made mistakes. I call my mistakes “tuition”…very expensive tuition.

Member Log In

Build a Successful Business Without Breaking the Bank!

Upcoming Events

Well, it really stinks to report that the conferences and events that we were planning to attend and speak at have been postponed due to the Covid-19 outbreak. Our leadership as well as the leadership of Castle Rock Capital Management still stand ready to help our subscribers and fans while we wait for things to get back to normal. If you have questions or if you wish our leadership to help you and your company succeed, please don’t hesitate to contact us through the contact section of this site. We look forward to getting back to our regularly scheduled events calendar very, very soon.