In addition to all of the consulting work we do for smaller investors and larger investors, we have our own funds, manage the funds of other entities, and we have a real estate practice that operates on the West Coast of Florida. It’s that real estate sales practice that gives us some of the most important information. It’s a canary in a coal mine, and I don’t mean the awesome song by The Police.

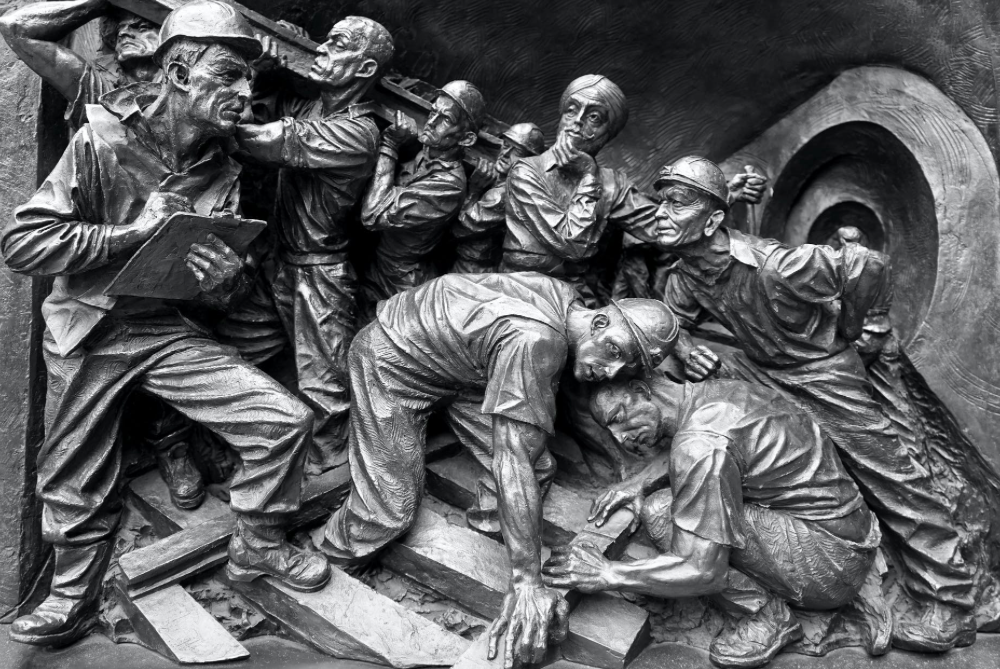

If you’re not familiar with what a canary in a coal mine means, here’s the scoop. Back in the day, odorless gasses would overwhelm miners from time to time. To solve this problem, miners would take a bird cage down into the mines with them. Since canaries are much smaller creatures than big, burly miners, those gasses would impact the birds first. When the canary keeled over, the miners knew it was time to get out. Our real estate business acts as a canary for our other businesses. When government entities and organizations like the National Association of Realtors post numbers, they are of what has already occurred. We get much better real-time consumer sentiment readings from how many buyers and sellers are out there.

It is true that with the Covid 19 pandemic, fewer buyers are out there, but the ones that are out there are serious buyers. That being said, the buyers still outnumber the sellers. This unbalanced scale still is favoring a slight increase in prices. How long will this continue? Who knows? Most prognosticators are predicting a drop in home values. They might be right, but unlike the last crash a few years ago, home inventory is very, very low and mortgage rates are even lower. We’re still seeing inventory move in the lower price-points.