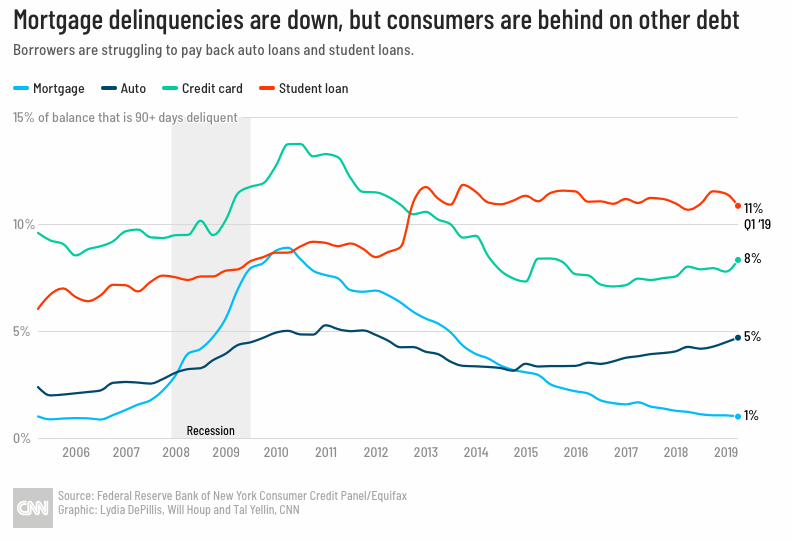

Data from Federal Reserve via CNN show that mortgage delinquency is at its lowest point in years, but other types of debt have delinquency rates that are much higher than in previous times. For instance, student loan debt is sitting at a whopping 11% as government-backed student loans have put younger people in debt deeper than their incomes can bail them out of. Although credit card delinquency is still a bit lower than it has been in the past (still at 8%), auto loan delinquency has steadily increased. With interest rates as low as they are, people are still keeping their heads above water, but it interest rates start to spike, look out!